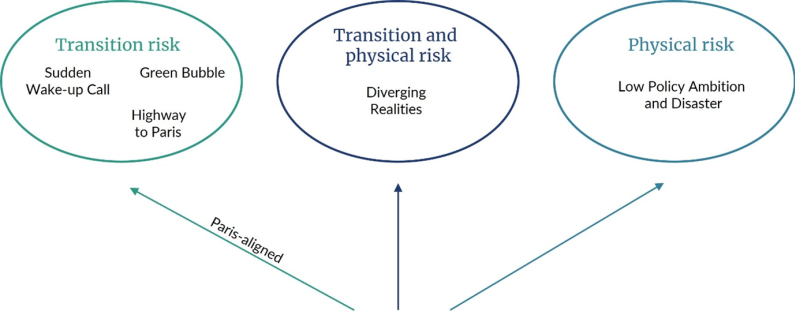

Highway to Paris

In this scenario there is a boom in green public investment which leads to a rapid reallocation of capital across sectors and internationally via cross-country capital flows and lending patterns.

Increased levels of uncertainty of fossil energy supply leads governments to implement an ambitious mitigation pathway in a timely and anticipated fashion.

Technology advances lead to a quick transition, resulting in disorderliness. Green prudential policies prevent financial turmoil albeit with losses in some sectors due to stranded assets.

Green Bubble

This scenario depicts a world where governments are unable to implement ambitious mitigation policy due to uncertainty in the fossil energy supply.

Green regulation overtakes government policies in driving the transition, leading to a glut of green private investment and the build-up of a green credit “bubble”. A sunspot/an unrelated random event leads to the burst of the bubble, a sharp rise in risk premia and a confidence crisis.

Sudden Wake-up Call

In this scenario elevated levels of uncertainty related to fossil energy supply limits governments in their ability to implement ambitious mitigation policy.

Driven by an event that triggers a sudden change in public opinion such as a severe natural disaster, an unanticipated and accelerated transition occurs.

The abrupt policy change sets off shock waves through the economy and financial system resulting in:

- stranded assets in polluting sectors

- severe financial stress internationally via capital trade and financial flows

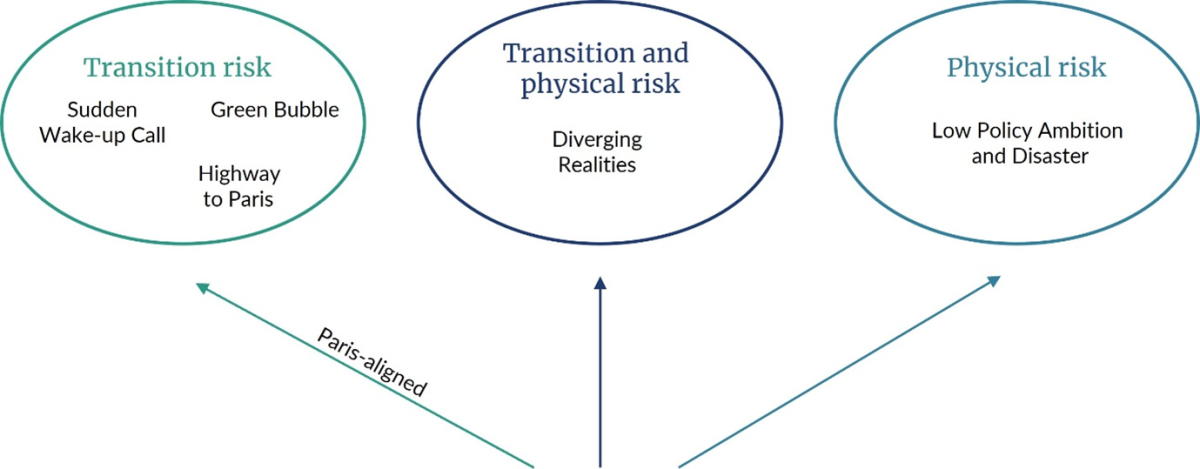

Low Policy Ambition and Disasters

Severe acute physical disasters hit exposed jurisdictions. Investors price in a sizeable risk premium, which freezes private investment, and reduce their exposure to the jurisdictions and sectors whose assets are at greatest risk of disaster losses.

Households consume less and save more due to the increase in uncertainty and insurance costs increase.

Diverging Realities

The world aims to avoid the worst impacts of global warming. However, severe natural disasters in the emerging market and developing economies and listed investment companies and a lack of external financing leads to recovery traps, a lack of fiscal space for affected regions to transition.

Meanwhile, the disruption of transition-critical mineral supply chains originating in disaster-prone regions hampers the speed of the global transition.

Other aspects of this scenario include:

- The sudden realisation that the global transition is too slow to avoid a hot house world.

- Sudden re-assessment of future physical impacts globally.

- Risk premia rise sharply.