Territorial authorities and the waste disposal levy

What you need to know about waste disposal levy payments.

What you need to know about waste disposal levy payments.

A levy on each tonne of waste sent to landfills is collected from landfill operators. See here for the levy rates set for different classes of landfills

Fifty percent of the levy collected by the Ministry for the Environment through the waste disposal levy is paid to territorial authorities (TAs) on a quarterly basis each year. The remaining money (minus administration costs) is put into:

TAs must spend the levy money they receive to promote or achieve waste minimisation. This spending must be in accordance with their waste management and minimisation plans (WMMPs). The amount of levy each TA receives is determined by the number of people in each district.

WMMPs prepared by each territorial authority set out how the levy will be used.

See Waste levy spending: Guidelines for territorial authorities.

Historically TAs provided a voluntary report to the Ministry each year describing how the levy had been spent. From 1 July 2024 this reporting became compulsory with the first report due in September 2025.

TAs must adopt a WMMP and review their plan every six years. Before adopting or reviewing a WMMP a territorial authority must conduct a waste assessment under section 51 of the Waste Minimisation Act 2008 (WMA).

Section 33 of the WMA requires the Ministry to retain levy money payable to a TA if the TA has not reviewed its WMMP in the six-year timeframe. The Ministry has no discretion here and has a legal obligation to retain the levy money if the WMMP review is not complete.

TAs may create a joint WMMP with other TAs.

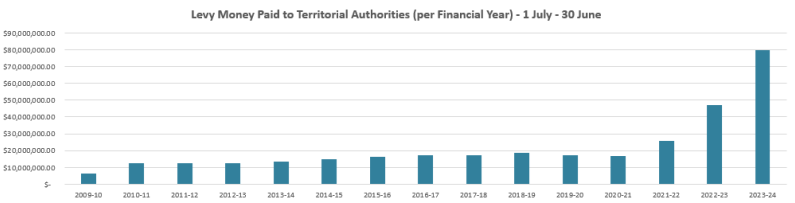

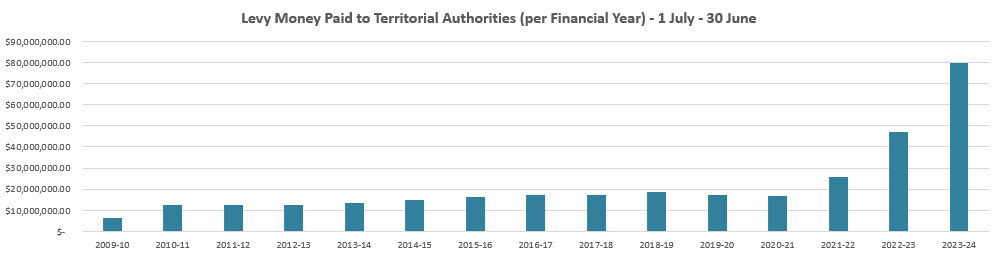

Data file [Excel, 89 KB]

The spreadsheet shows all payments to each TA.

Each TA must plan for and undertake their own spend activity in accordance with the requirements of the WMA and their WMMP.

Most WMMPs generally contain some flexibility in describing how each TA will spend their allocated levy funds. The Ministry recommends that, where possible, TAs maximise the use of levy funds on initiatives where the highest impact on waste minimisation will be seen (ie, focusing on the top end of the waste hierarchy and prioritising spend on those initiatives which reduce waste, followed by reuse, then recycling etc).

These could include:

As set out in the levy spend guidelines, where spending is not specifically set out in a WMMP but where additional spend can be tied back to the objectives and methods set out in the WMMP, it is good practice for TAs to be able to demonstrate:

The TA could consider whether funds should be accrued (if possible in an interest-bearing account to maximise opportunity from levy funds), until such time as they are due to review their WMMP.

If a TA does not wish to accrue funds and wants to amend their objectives and methods in their WMMP, this will require a review of the WMMP in accordance with section 44 of the WMA.

This does not necessarily have to be a full review, but it needs to refer to the most recent waste assessment, and use the special consultative procedure set out in section 83 of the Local Government Act 2002 (also seek direction from your TA’s Significance and Engagement Policy on this).

It should be noted that a full review and waste assessment would still need to be undertaken within six years from the original WMMP.