Regulations supporting tyre product stewardship

The regulations support product stewardship of tyres. They came into force on 1 March 2024.

Official title

Waste Minimisation (Tyres) Regulations 2023

Under the

Lead agency

Ministry for the Environment

The regulations support product stewardship of tyres. They came into force on 1 March 2024.

Waste Minimisation (Tyres) Regulations 2023

Ministry for the Environment

Waste Minimisation (Tyres) Regulations 2023 [NZ Legislation website]

1 March 2024

However, the following provisions came into force on 1 September 2024:

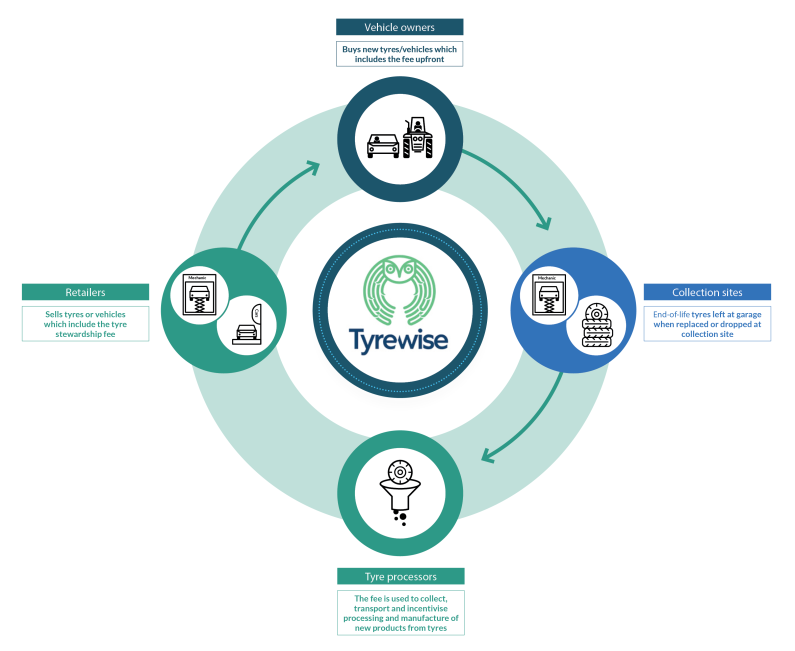

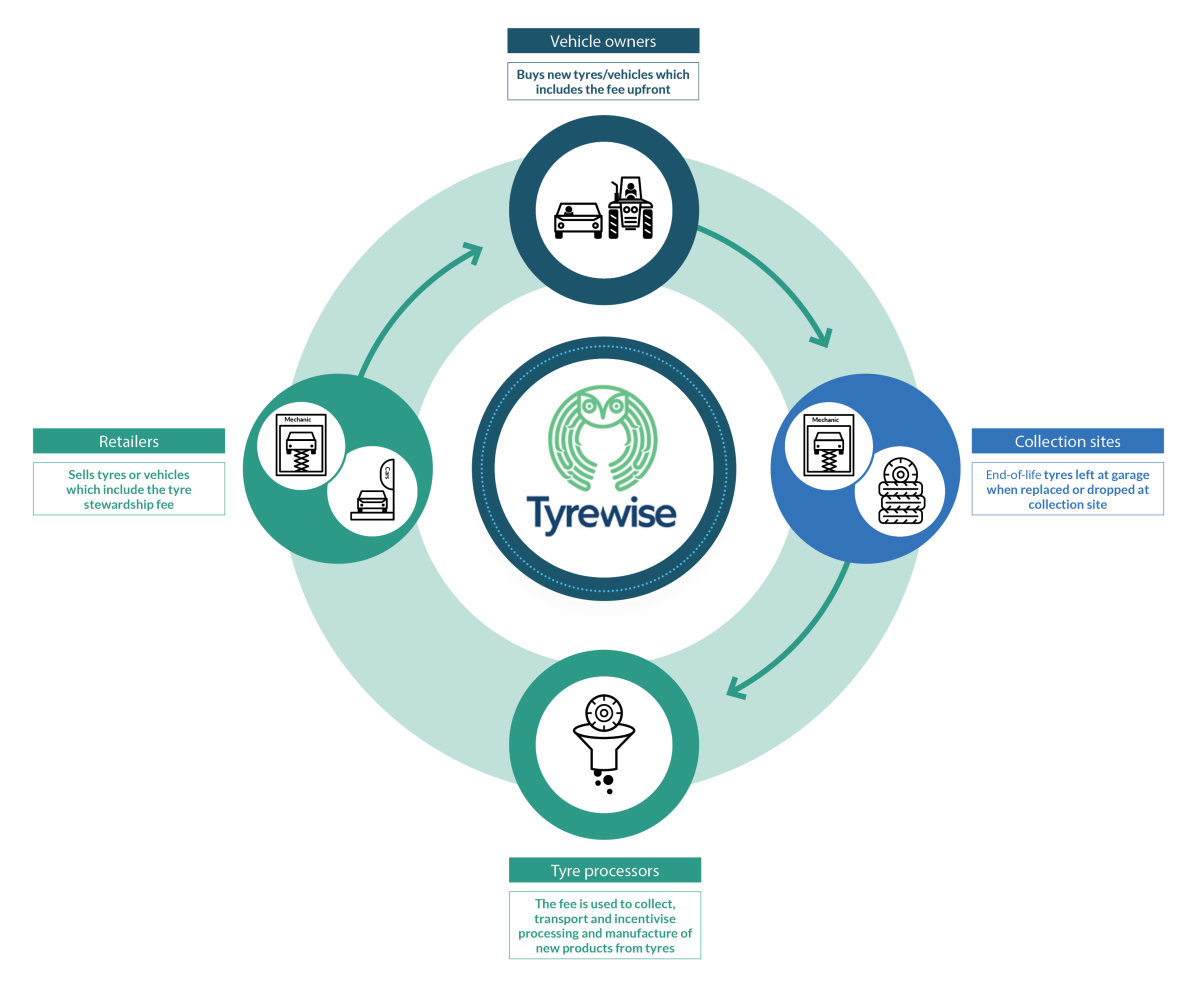

The circular Tyrewise cycle is:

The circular Tyrewise cycle is:

The regulations support an accredited priority product stewardship scheme for tyres known as Tyrewise.

The aim of Tyrewise is to:

The Tyrewise scheme was developed by a stakeholder working group and accredited in late 2020. The accreditation is held by Auto Stewardship New Zealand (ASNZ), a not-for-profit product stewardship organisation.

The scheme is currently going through a re-accreditation process to align with the new regulations and feedback from key industry stakeholders and ASNZ.

They came into effect in two phases.

From 1 March 2024, tyres must be sold in accordance with the accredited tyre scheme.

To fund the scheme, the tyre stewardship fee (the fee) is collected on all regulated tyres when they enter the New Zealand market.

From 1 September 2024, the scheme began full operations.

Scheme participants receive payments for the services they provide that involve end-of-life tyre movements, such as running a public collection site or transporting the tyres.

Incentive payments are available to support the recovery of raw materials found in end-of-life tyres.

Currently, the costs of end-of-life tyres largely fall on communities, local government, and the environment.

A regulated product stewardship tyre scheme ensures that producers take responsibility to minimise the waste and harm caused by tyres at the end of their usual useful life.

This is part of the government’s comprehensive waste minimisation work programme. It supports the goal of moving to a circular economy.

Further background information on the regulations is in the 2021 consultation document [PDF 1.4 KB]

The regulations prohibit the sale of regulated tyres except in accordance with the accredited scheme.

From 1 March 2024, the fee must be paid by:

From September 2024, members of the public are able to take their end-of-life tyres to registered collection sites (eg, a mechanic, tyre retailer or community collection site) to be managed at no cost to them through the scheme. However, only tyres that have had a fee paid by liable parties are accepted by the scheme.

The fee replaces existing ad-hoc tyre collection fees often charged by tyre retailers to their customers for the disposal of end-of-life tyres.

Because they were not regulated, these ad-hoc fees did not guarantee the safe disposal of end-of-life tyres. In contrast, the tyre stewardship fee allows a transparent chain of custody for these tyres.

From 1 March 2024, businesses and individuals who sell tyres must register with the scheme by visiting the Tyrewise website and complying with the scheme’s guidelines.

Registered participants in the Tyrewise scheme help the scheme manager to achieve their targets by providing services for the management of end-of-life tyres and following the scheme’s guidelines.

Operators of end-of-life tyre collection, transportation, and processing services will enter into agreements with the scheme to provide their services for the sustainable management of end-of-life tyres. The scheme manager will report on the scheme’s performance to the Ministry.

Tyrewise will pay service fees to tyre collectors and transporters, and provide incentive payments to tyre processors and manufacturers for domestic uses. The types of activities eligible for incentive payments are set in regulations. No incentive payments will be offered for exported tyre products.

The regulations:

The cost of the fee and types of tyres it covers are described in the regulations [New Zealand Legislation website].

The fee varies depending on the type (and size) of tyre. It replaces the disposal fees charged by many tyre retailers.

Refer to paying the fee guidance for details on how the fee will be collected for different importer types.

The fee must be paid as per the following:

Refer to Schedule 2 - Fees for regulated tyres [NZ Legislation website]

The fee is set as follows:

Contact Tyrewise if you have questions about the tyre product stewardship scheme operations, governance, or scheme participant requirements.

Contact the Ministry’s Resource Efficiency Policy Team if you have questions on the tyre product stewardship regulations or the fee.